Grow Your Business with Flexible Equipment Financing

Unlock the capital your established business needs to thrive with our dedicated Equipment Financing. Designed to offer predictable payments and no maximum funding cap, this program provides the flexibility and long-term value you need to acquire the machinery and capabilities essential for growth.

Why Choose Equipment Financing?

Equipment financing is a unique, powerful tool for established business owners looking to acquire new or upgraded equipment without disrupting operating capital.

No Industry Restrictions: Our program is flexible and available to businesses across virtually all sectors.

Tax Advantage: Benefit from full tax write-offs for equipment purchases as a business expense, reducing your overall tax liability.

No Funding Cap: Acquire all the necessary equipment for your operations, as this option has no maximum funding limit.

Long-Term Value: Finance your essential assets with terms structured for flexibility and built for long-term value creation.

Key Loan Features & Benefits

Funding Amount: No maximum funding cap

Flexible Terms: 3 to 7 years

Interest Rates: Competitive, predictable monthly payments

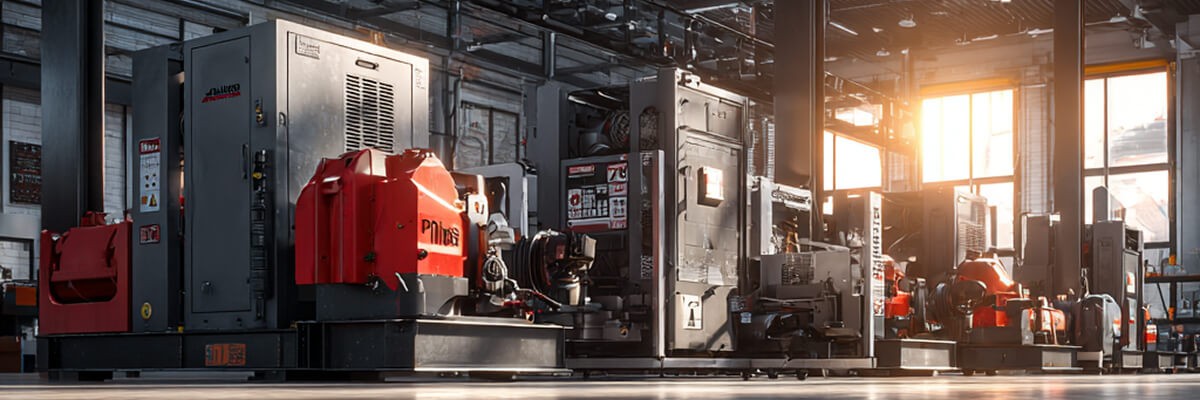

Purpose: Purchase, upgrade, or acquire machinery and essential business equipment

Qualifying for Equipment Financing

Our equipment financing program is specifically designed for established businesses that demonstrate stability and a clear need for asset acquisition. Meeting the following requirements is the first step toward securing your funding:

Minimum Business Requirements:

Operating History: At least 1 year in operation.

Annual Revenue: Gross annual revenue of $250,000 or more.

Credit Score: A minimum personal FICO score of 650 or above.

Documentation: A qualifying invoice for the equipment to be purchased.